The European Union is on the verge of launching the EUDI Wallet, a trusted digital identity framework that will soon become mandatory across all member states. For banks and financial institutions, this isn’t just another compliance requirement, it is a transformative shift in how customers will authenticate, transact, and share data. Those who prepare early can reduce regulatory risk, streamline operations, and seize new business opportunities, while late adopters risk being left behind.

The Future of Digital Identity in the EU

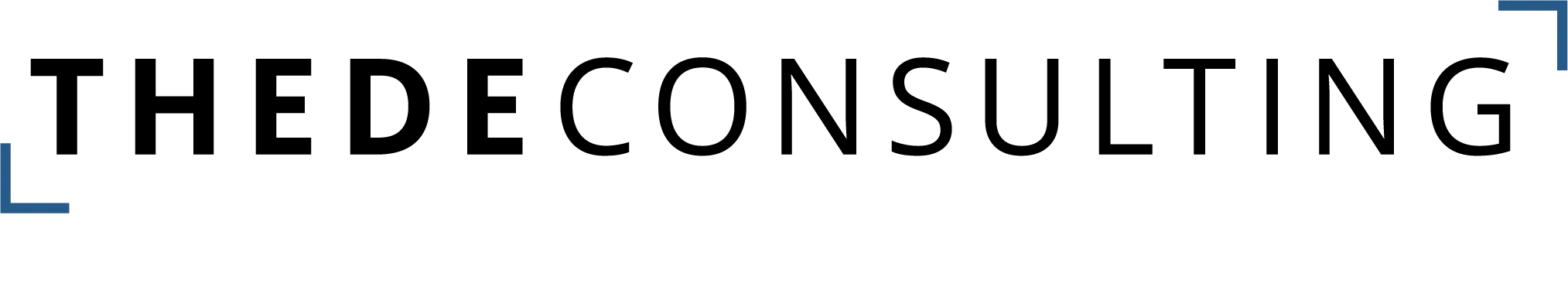

In 2024, the European Union introduced eIDAS 2.0, a revised regulation on electronic identification and trust services that is fundamentally reshaping the regulatory landscape for digital identity and trust services across Europe. eIDAS 2.0 officially came into force in May 2024, marking a significant milestone in the EU’s digital transformation journey. The overarching goal of eIDAS 2.0 is to provide every EU citizen and business with the means to securely identify themselves and share verified credentials online, thereby fostering a seamless digital single market.

At the heart of this transformation is the European Digital Identity Wallet (EUDI Wallet), a secure, user-centric solution for managing digital credentials and enabling trusted transactions throughout the EU. By December 2026, each EU member state is required to offer at least one EUDI Wallet, ensuring broad accessibility for citizens and businesses. Furthermore, by December 2027, public and regulated private sector entities – including banks and financial services – must accept the EUDI Wallet for identification and authentication purposes.

The EUDI Wallet is designed to support a wide range of use cases, such as accessing government services, opening bank accounts, making payments, and digitally signing documents. The ecosystem is set to expand further with an amendment expected in Q4 2025, introducing a dedicated EU Business Wallet (EUBW) for organizational credentials. The EUBW will further broaden the scope and utility of the EUDI Wallet ecosystem.

eIDAS 2.0 and EUDI Wallet

How the EUDI Wallet will Impact Banking and Financial Services

Mandatory Acceptance and Integration

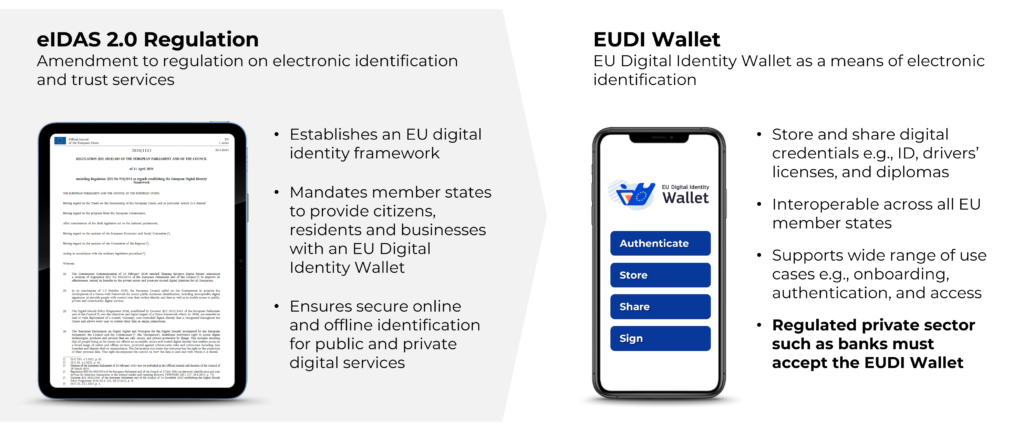

By 2027, banks and financial service providers will be legally required to accept the EUDI Wallet for key processes, including customer onboarding (KYC/KYB), payments (with Strong Customer Authentication, SCA), and digital signatures. This mandate is not only a compliance obligation but also serves as a catalyst for innovation and operational efficiency within the financial sector.

KYC and KYB in Customer Onboarding

The EUDI Wallet streamlines Know Your Customer (KYC) and Know Your Business (KYB) processes by enabling the secure, standardized exchange of verified digital credentials. Customers can open bank accounts remotely, using the EUDI Wallet to share only the necessary information with explicit consent and minimal friction. This approach reduces onboarding costs, improves data quality, and enhances the overall customer experience.

Payments and Strong Customer Authentication (SCA)

For payments, the EUDI Wallet introduces a unified, high-assurance authentication method. Banks must facilitate Strong Customer Authentication via the EUDI Wallet upon payer request, supporting both card-based and account-based transactions. This not only fulfils regulatory requirements under (expectedly) PSD3 and eIDAS 2.0 but also reduces fraud and enables innovative payment experiences such as “Fast Checkout”.

Digital Signatures and Consent Management

The EUDI Wallet supports legally binding digital signatures and robust consent management. It allows customers to authorize data sharing and transactions with full transparency and control. These capabilities are particularly relevant for loan agreements, account servicing, and other high-value interactions.

Opportunities and Challenges for Banks and Financial Services

The EUDI Wallet offers significant benefits for financial institutions, including fully digitized, automated onboarding and servicing processes. It enhances security, reduces fraud, and streamlines compliance with eIDAS 2.0, PSD3/PSR, and AML regulations. Additionally, the EUDI Wallet enables the development of new, identity-enriched services and business models, providing a competitive edge for early adopters.

Opportunities for Banks

However, the transition to the EUDI Wallet is not without challenges. Financial institutions must adapt to evolving technical standards, integrate with potentially 27+ different national wallets, and navigate overlapping regulations such as eIDAS 2.0, PSD2/3, and AML.

How Banks and Financial Services need to prepare now

To prepare for and leverage the EUDI Wallet, financial institutions should adopt a strategic, multi-faceted approach:

Strategic multi-faceted approach

1. Market Positioning and Business Model Innovation

Financial institutions should explore new business models that leverage verified digital identities, such as instant lending, cross-border account opening, and personalized financial services. Early adoption positions banks and financial services as trusted innovators and enables competitive advantages.

2. Technical and Operational Readiness

Institutions should integrate EUDI Wallet support into onboarding, authentication, and payment flows to ensure seamless customer experiences across all channels. Optimizing resources by clearly defining roles and responsibilities, avoiding duplicate investments, and aligning with evolving technical frameworks will further support a smooth transition.

3. Compliance and Risk Management

Aligning existing KYC/AML processes to EUDI Wallet requirements is crucial for identifying overlaps and gaps. Legal and customer communication frameworks should be updated to reflect new consent, data protection, and authentication mechanisms. Ongoing monitoring of regulatory developments e.g., the upcoming amendment for the EUBW, PSD3, and AML will help ensure compliance and interoperability.

4. Customer Education and Support

Developing comprehensive customer education programs is vital to drive adoption and build trust in the EUDI Wallet. Updating customer support channels and staff training will ensure that wallet-related queries and issues are handled effectively.

Your Partner for the EUDI Wallet Transition

Thede Consulting, part of the Projective Group, supports financial institutions in the transition to eIDAS 2.0 and to fully leverage the opportunities of digital identities such as the EUDI Wallet. Together with our clients, we develop strategies that consider both the business potential of the EUDI Wallet and its regulatory requirements. We create a clear market positioning for our clients and to anchor future-oriented topics early on within their organizations. We pursue a holistic approach that reaches from strategy to implementation and enables sustainable differentiation in the competitive landscape.

Start prepared into the EUDI Wallet era and future-proof your business together with us.

Do you have further questions about the EUDI Wallet and the implications for your organisation? Feel free to reach out to our experts for further information.

Please also see our article on The Paypers.

Dr. Carlos Nasher

Simon Wallner