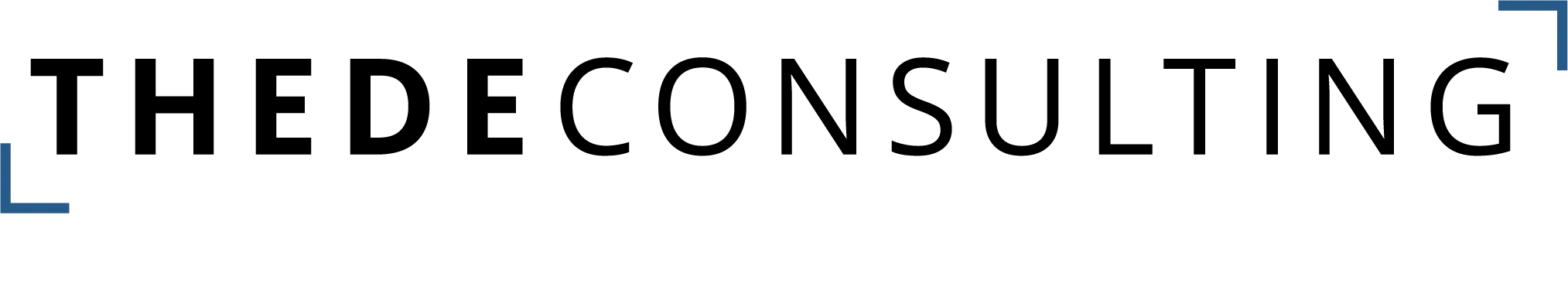

Between the dynamic poles of digitalization, regulation and cyber security, future drivers are having a major impact on today’s payment industry. As the first in a three-part series, this article takes a closer look at current trends and innovations shaping the digitalization in payment.

Various trends and innovations are influencing the payment industry and driving the trend towards the digitalization in payment. The European Payment Initiative (EPI) launched P2P and its digital wallet solution Wero for payments is on the doorstep. EPI strives to offer a multi-channel payment solution with increased flexibility of financial transactions by integrating various payment methods, enhancing security and providing a user-friendly interface. The integration of additional card products, the digital euro and eID are planned. A shift from the financial services of a traditional house bank to embedded financial services is also recognizable in the banking sector. The trend of managing all financial matters at one’s own bank is moving very strongly towards the use of service providers and FinTech’s who are embedding banking services under one big umbrella for their customers. Digitalization therefore not only brings many opportunities for merchants and banks, but also holds challenges that need to be overcome. We will take a closer look at the digital euro and its possible impact on Europe’s payment market.

Triangle of digitalization, regulation and cyber security in the payment industry

The digital euro – A deep dive into one of many digital innovations

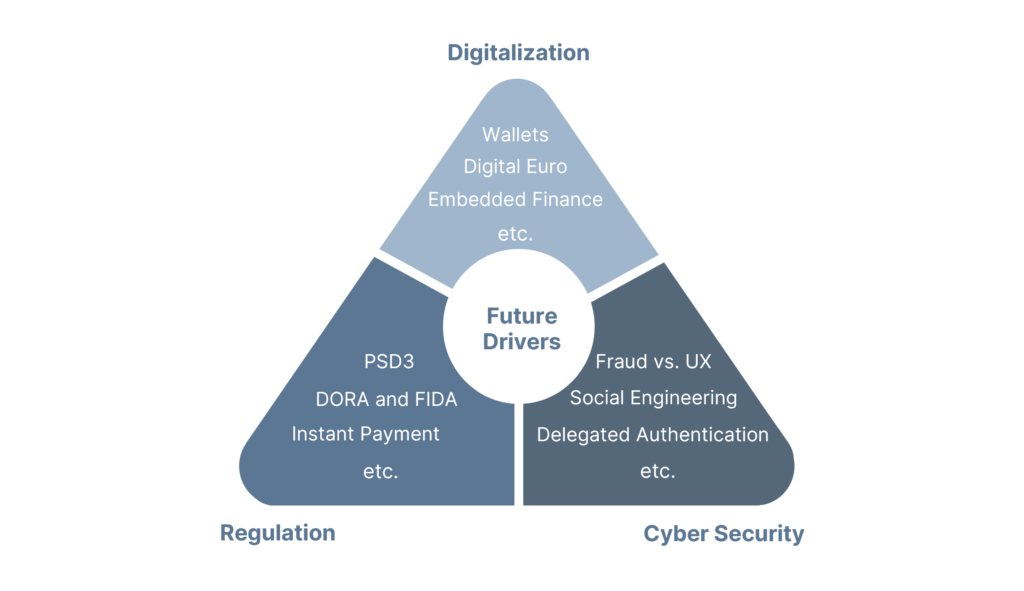

The European Central Bank envisions a digital version of euro cash issued by the central bank and made available to all residents of the eurozone. This vision involves end users receiving a free electronic wallet that enables free transactions in real time. With the possible launch of the digital euro, the European Central Bank wants to achieve greater independence in a standardized European payment system. It also wants to ensure the stability and security of the European financial system while promoting innovation for digital business models. The final decision on the introduction of the digital euro by the EU governance bodies is foreseen for the end of 2025.

Processing of the digital euro in the existing euro system

Challenges for a successful launch of the digital euro

One of the biggest challenges is to build the required infrastructure and ensure that the digital euro can be used securely and efficiently. Beyond that, there are also legal and regulatory aspects that need to be resolved in order to integrate the digital euro into the existing European financial system. Competition with already established payment methods, such as PayPal or international credit card schemes, can also represent a challenge for the successful implementation of the digital euro. In this context, a further risk is the lack of acceptance among end users and merchants.

Opportunities of the digitalization in payment

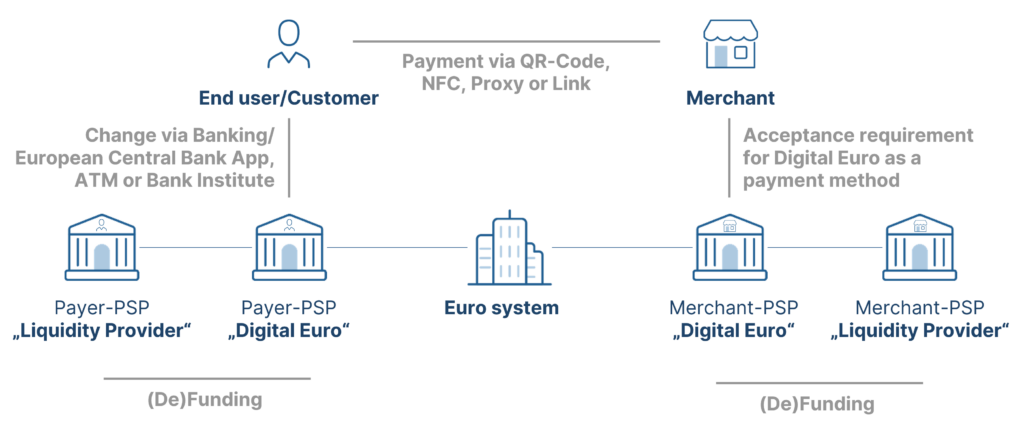

For end users, the digital euro offers legal tender as digital money, free of charge for basic services, processed in real time and usable without internet connection. The obligation to accept the digital euro for merchants would ensure that consumers can use it across all areas.

The requirement to accept the digital euro could give merchants a stronger position in negotiations with other payment method providers. Furthermore, the introduction of the digital euro could reduce transaction costs, as no scheme fees are to be incurred in the system. The costs will be covered by the Euro System. The so-called ‘zero-interday holding limit‘ applies to merchants’ wallets, meaning that the digital euro must be transferred to the merchant’s bank account within one day of receipt of funds. Merchants can therefore access their funds immediately, which improves liquidity. Moreover, the digital euro offers merchants the opportunity to increase their conversion rates, which could lead to a higher completion rate on sales. Universal acceptance of the digital euro across the eurozone would allow merchants to reach a wider range of customers and make cross-border transactions much easier.

For banks, the digital euro opens up the potential to expand their customer base and strengthen the loyalty of existing customers by offering new features and more extensive services. As the Euro System is state-funded, banks could benefit from a reduction of scheme and settlement fees, which could lead to cost savings. In addition, banks can develop new business models and services based on the digital euro and therefore remain competitive on the payment industry.

Planned media and use cases for the digital euro

Advice on handling the digitalization of the payment industry

Considering the political role, it can be assumed that the digital euro will play a role in the future payments mix – depending largely on the structure, the behavior of market players and the general development of the payments market over the next few years. It is important to emphasize that the digital euro will enhance existing payment structures (e.g. issuers and acquirers), but will not replace them.

With reference to further trends and innovations in the field of digitalization, merchants and banks should use the time now to analyze their payment architecture and revise their portfolio to be prepared for the future in all directions of digitalization.

Merchants should prepare for the future at an early stage and optimize their payment acceptance architecture. Topics such as payment orchestration and smart routing are relevant to reduce costs, increase conversion and optimize the payment load as well as to ensure future readiness.

Banks in return face the challenge of developing a payment transaction strategy that meets the real needs of their customers and uses the regulatory framework to create value. Payment must be considered as a holistic strategy to meet the requirements of the future. Only with a comprehensive and future-oriented strategy at hand banks, merchants and end customers are able to benefit from the advantages of the digital euro and meet the challenges of the modern payment world.

In the next article of this three-part series, we will take a closer look at the regulatory requirements, such as PSD3 and PSR – What impact does this new wave of regulation have on the payment industry and what does it mean for merchants and banks?

This article was first published on ‘The Paypers‘.

What impact does the digital euro have on your company?

Discover in our exclusive workshop “NextGen Payments: Revolution or Evolution by 2030?” how the digital euro and the future drivers of digitalization, cyber security and regulation will affect your business models and how you can make your company future-proof.

We look forward to hearing from you and will be happy to answer any questions you may have.

Dr. Carlos Nasher