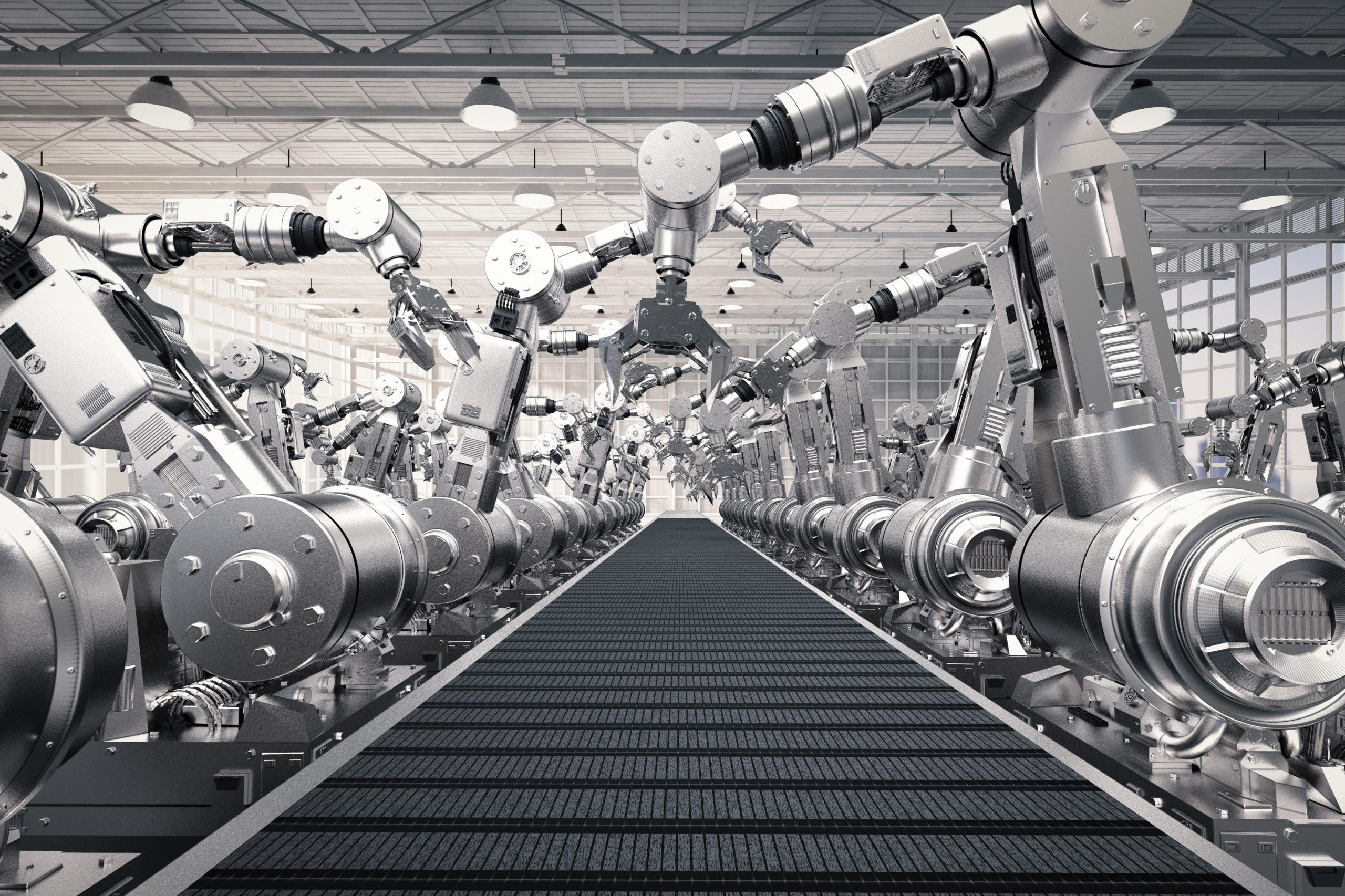

Payment strategy for the industry

An efficient payment strategy for the Industry 4.0 is crucial. The digitisation of the industry requires a change in mindset for the entire value chain in order to secure your own competitiveness and innovative strength. Thus, efficient payment processing for innovative business models and sales formats plays a central role in this. Industrial clients, just […]